Generated over 850K in sales in 30 Days

Creating your own TV show requires a great idea, investor funding and a lot pre-production planning. Some of the steps we followed when creating The Unicorn were: 1. Creating a compelling and highly engagement show “premise” based on market research and market performance of similar shows in the past. (2) Choosing a show format (reality TV or scripted, documentary or fictional) that will lend itself to multiple variations - linear programming, online streaming and social media sharing. (3) Find and choose hosts and characters that resonate and connect with the target audience. There are many other steps, but these should help you get started ideating your TV show concept and thinking about the next steps.

Yes, we work with startup TV shows in all stages of production to help brand, ideate, produce and distribute TV Shows. In addition, we can help find influencers, hosts and talent for your new show idea. Connect with us to chat more about your concept.

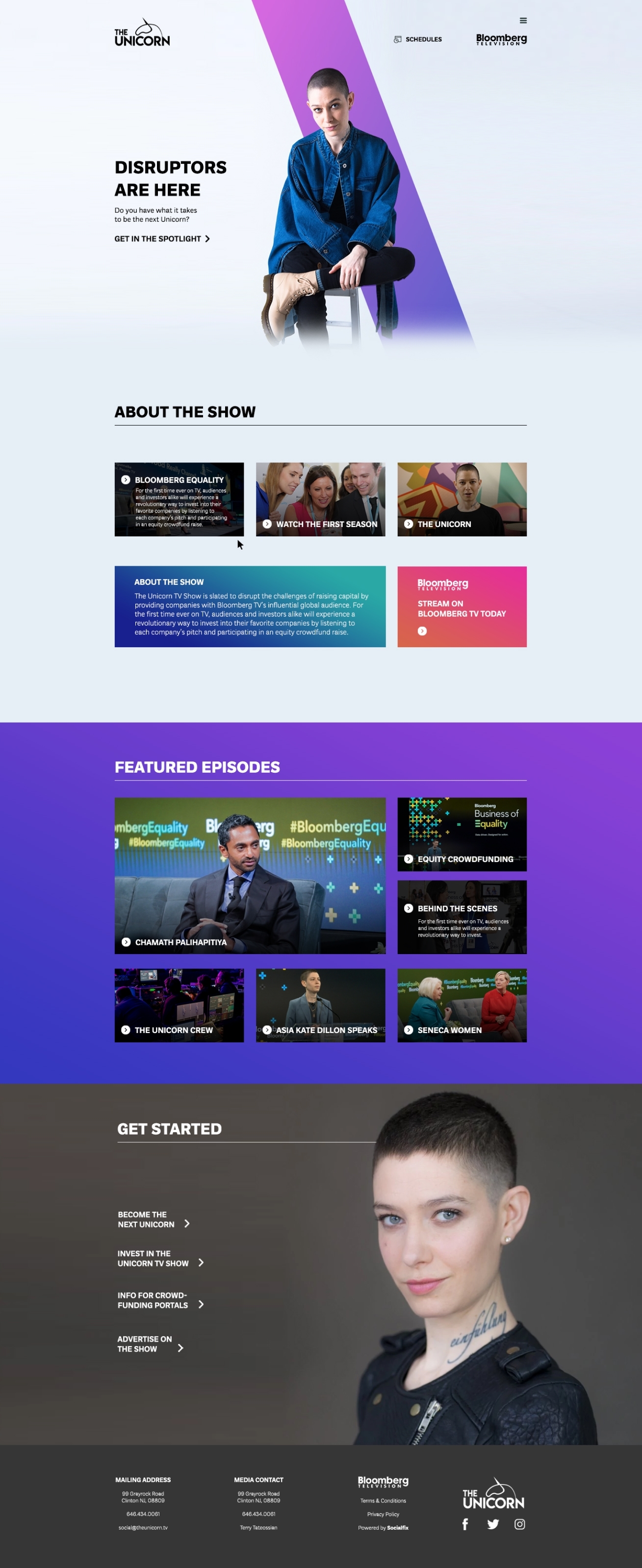

Marketing your TV Show efficiently and effectively requires a detailed marketing strategy and implementation plan. We like to deploy omni-channel strategies that take advantage of of the unique opportunities on each channel - for example: Facebook groups and communities, retargeting, remarketing and paid social. The ultimate goal is to create a community of loyal fans that are committed and engaged to the outcome of each episode.

Creating and producing a successful TV show is a time consuming and expensive project. You do not necessarily need an angel investor if you are able to self fund. However, we highly recommend you collaborate with or invite potential angel investors to help move the project forward if there are unexpected delays or unforeseen expenses. You dont want to get ¾ of the way there, and run out of capital. Having angel investors may help you get the project over the finish line if the need arises.

Equity crowdfunding (also referred to as “crowd-investing” or investment crowdfunding) is a method of raising capital for early stage startups that invites potential investors or “the crowd” to contribute capital in exchange for shares in the company. Investors are shareholders who then have ownership in the company and stand to profit if the company succeeds or sells in the future. This form of capital raising provides non-accredited investors or regular people with the opportunity to invest in innovative early stage companies.

Equity crowdfunding replaces the traditional path of raising capital in the early phase of a startup by offering founders and creators the opportunity to connect with a much larger group of investors or “the crowd” and raise a small amount of money from each “backer” in exchange for ownership interest in the form of shares “or equity” in future of the company. If the company succeeds, so will its shareholders. If the company fails, all investors involved will also not see their investment grow or returned to them.

The benefit of equity crowdfunding for the founders or creators is access to larger pool of investors and an opportunity to grow their company 10X. The benefit for the investors is the opportunity to to invest small amounts of money into an early stage startup with the hopes of succeeding or backing a new company based on their own missions and personal values.

There are hundreds of equity crowdfunding platforms where a startup can raise capital. Some of the most popular and successful are: Republic, WeFunder and StartEngine. To learn more, have a listen to Chuck Pettid, CEO of Republic Crowdfunding Portal on our podcast being interviewed by our founder Terry Tateossian.

According to some sources, the first equity crowdfunding campaign was launched in 2007 in Australia.

Absolutely. We help startups and founders create crowdfunding campaigns, videos, content, offers, and everything in between. Please connect with us to chat about your crowdfunding needs.

See More